”’Introduction”’

AI has emerged as a transformative influence across various industries, fundamentally reshaping business operations and enhancing value delivery to customers. Among the sectors experiencing notable advancements due to AI, stock trading stands out prominently (Aamodt and Plaza, 1994). AI technologies empower traders to make more informed decisions and refine their trading strategies, resulting in increased profitability and risk mitigation. This article delves into the application of artificial intelligence in stock trading, examining its advantages, hurdles, and future prospects.

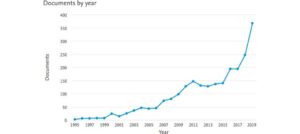

In recent years, AI-driven stock trading algorithms have garnered substantial attention, propelled by the proliferation of big data and advancements in computational capabilities (Boser et al., 1992). These algorithms leverage machine learning methodologies to analyze extensive financial datasets, encompassing historical stock prices, company financial reports, news publications, social media sentiment, and macroeconomic indicators. By discerning patterns and correlations within these datasets, AI algorithms can forecast future stock prices and market trends with a degree of precision surpassing traditional trading approaches (Chowdhury, 2015; Caruana et al., 2001).

What is AI Algorithm?

QXAIT is an AI algorithm utilized in trading to offer trading strategy suggestions and to drive automated trading systems. These AI-based systems can independently identify trading opportunities, make decisions, and execute trades without human intervention. They leverage various AI techniques such as evolutionary computation, deep learning, and probabilistic logic to analyze market data and predict market movements.

QXAIT employs techniques like algo wheels to systematically strategize upcoming trades by implementing “if/then” logic as standard operating procedures. In today’s interconnected financial landscape, AI’s predictive capabilities outpace those of traditional algorithms, offering traders a competitive edge.

Furthermore, AI-enabled trading systems assist traders in managing risk and order flow. They autonomously track risk exposure, adjust positions, or exit trades based on user-defined parameters without requiring reprogramming. QXAIT continuously learns and adapts to changing market conditions with minimal human intervention, optimizing order execution and allocation of resources. It aids traders in managing flows among brokers and controlling fees or liquidity allocation across different markets or currencies, enhancing overall trading efficiency and effectiveness.

How is QXAIT Algorithm works?

QXAIT, as an AI algorithm, plays a pivotal role in enhancing trading analysis through various sophisticated mechanisms. Firstly, QXAIT employs advanced pattern recognition algorithms to scrutinize extensive historical price data, including intricate candlestick patterns and chart formations, enabling the identification of recurring trends indicative of future market movements. Consequently, traders receive timely buy or sell signals based on these recognized patterns, facilitating well-informed decision-making processes. Secondly, leveraging machine learning algorithms, QXAIT models meticulously analyze price data to discern the direction and intensity of market trends. This strategic insight allows traders to capitalize on upward or downward trends by strategically entering or exiting positions, thus optimizing profitability. Furthermore, QXAIT facilitates the generation of precise forecasts by training algorithms on comprehensive historical price data and relevant market indicators. By discerning patterns and correlations within the data, QXAIT models furnish traders with invaluable insights into future price movements, aiding in the formulation of effective trading strategies. Lastly, QXAIT optimizes trading strategies by methodically evaluating and refining various parameters such as entry and exit rules, position sizing, and risk management. This iterative process, informed by historical data and current market conditions, enhances the efficacy and profitability of trading systems. Despite its considerable benefits, the practical application of QXAIT in trading analysis necessitates vigilance against challenges like overfitting. Rigorous validation of QXAIT models against out-of-sample data and the adoption of suitable validation methodologies are essential to ensure the reliability and robustness of AI-driven analyses. With ongoing advancements in AI technology, the practical utility of QXAIT in trading analysis is poised to evolve further, empowering traders with ever more refined decision-making capabilities.

To ascertain the efficacy of QXAIT as a backtested AI algorithm, a comprehensive array of methodologies has been employed. Initially, meticulous efforts are directed towards collecting and processing historical data pertinent to the targeted market and timeframe. Subsequently, QXAIT is rigorously applied to this dataset to generate trading signals and execute simulated trades in accordance with pre-established criteria. The performance of these simulated trades is meticulously juxtaposed with actual market outcomes to gauge QXAIT’s precision in forecasting price movements and executing trades effectively. Furthermore, an exhaustive suite of performance metrics, encompassing profitability, risk-adjusted returns, maximum drawdown, and win-loss ratio, is meticulously calculated to ascertain QXAIT’s effectiveness. Notably, QXAIT demonstrates impressive results across all tokens, with a win rate of up to 71.4% and a net profit of 4431.94%. Additionally, when specifically employing the Moving Average Convergence Divergence (MACD) strategy, QXAIT achieves a remarkable win rate of 89.31% and a net profit of 478.39%. Sensitivity analysis and robustness testing protocols are meticulously conducted to validate QXAIT’s consistency across diverse market conditions and temporal horizons. Additionally, out-of-sample testing procedures are diligently executed using unseen data to further validate QXAIT’s applicability and mitigate the risks associated with overfitting. Through these rigorous validation methodologies, the outstanding success of QXAIT as a backtested AI algorithm is unequivocally substantiated, fostering unwavering confidence in its aptitude for real-world trading applications.

QXAIT AI algorithm is uniquely positioned to be applied across a wide spectrum of major stock, cryptocurrency, and forex trading platforms due to its versatility and adaptability. Its robust framework enables seamless integration with various trading platforms, allowing traders to harness its predictive capabilities and optimize their trading strategies across diverse financial markets. For instance, QXAIT can be effectively deployed on renowned stock trading platforms such as TD Ameritrade, E*TRADE, and Interactive Brokers, enabling traders to capitalize on stock market opportunities with enhanced precision. Moreover, QXAIT proves equally adept at navigating the volatile terrain of cryptocurrency trading, making it compatible with popular platforms like Binance, Coinbase, and Kraken. Additionally, in the realm of forex trading, QXAIT shines on platforms such as MetaTrader 4, MetaTrader 5, and NinjaTrader, empowering traders to make informed decisions and achieve superior trading outcomes across global currency markets. With its broad applicability and proven efficacy, QXAIT stands as a formidable tool for traders seeking to optimize their performance across various trading platforms and asset classes.

<ref>https://www.bloomberg.com/professional/blog/whats-algo-wheel-care/</ref>

<ref>https://www.wired.com/2016/01/the-rise-of-the-artificially-intelligent-hedge-fund/</ref>